The North News

Chandigarh, February 6

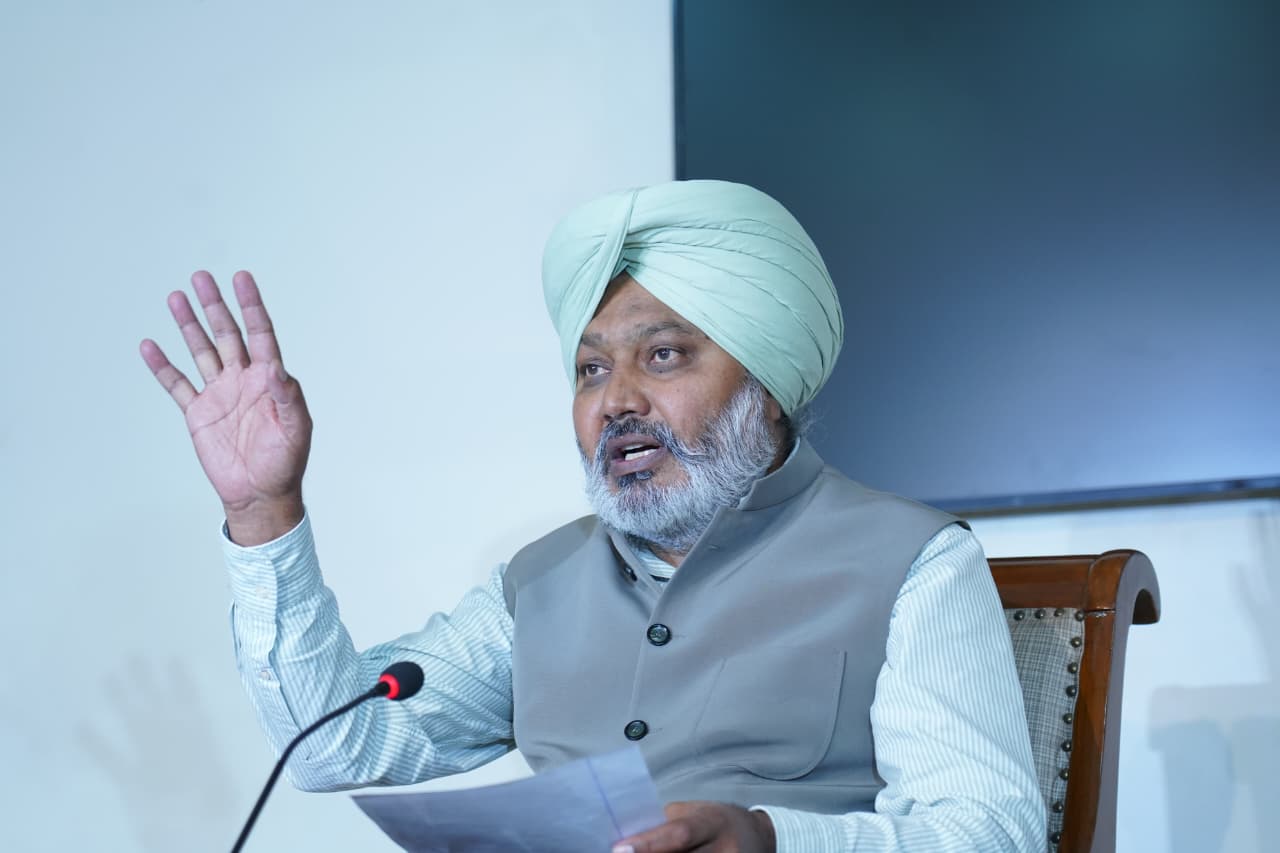

Punjab’s Finance, Excise and Taxation Minister Harpal Singh Cheema has said the state government’s One Time Settlement of Outstanding Dues, 2025 (OTS-2025) has helped recover ₹110 crore so far, while offering substantial relief to traders.

In a statement issued on Friday, Cheema said the Taxation Department had received 7,654 applications since the scheme was launched on 1 October 2025. He said the response had led to waivers amounting to ₹38,477 crore, calling it an indication of the Bhagwant Mann government’s focus on voluntary tax compliance rather than prolonged legal disputes.

The minister said the deadline for availing the scheme had been extended from 31 December 2025 to 31 March 2026 following requests from industry bodies and the strong uptake of the scheme. He said the extension would give eligible taxpayers more time to assess their liabilities and opt for settlement through what he described as a transparent and simplified process.

Reiterating the government’s commitment to improving the ease of doing business, Cheema said the scheme offers a 100% waiver of interest and penalties across all categories. He added that slab-wise relief on the principal tax includes a 50% waiver for dues up to ₹1 crore, 25% for amounts between ₹1 crore and ₹25 crore, and 10% for dues exceeding ₹25 crore. Similar relief is available under provisions of the Punjab General Sales Tax Act, 1948, and the Punjab VAT Act, 2005.

Appealing to traders to take advantage of what he described as a one-time opportunity, the minister said those who do not opt for the scheme may face action under the law. He added that all taxpayers, except government food grain agencies, are eligible to apply by submitting the prescribed form to the jurisdictional Assistant Commissioner of State Taxes.