The North News

Chandigarh, February 3

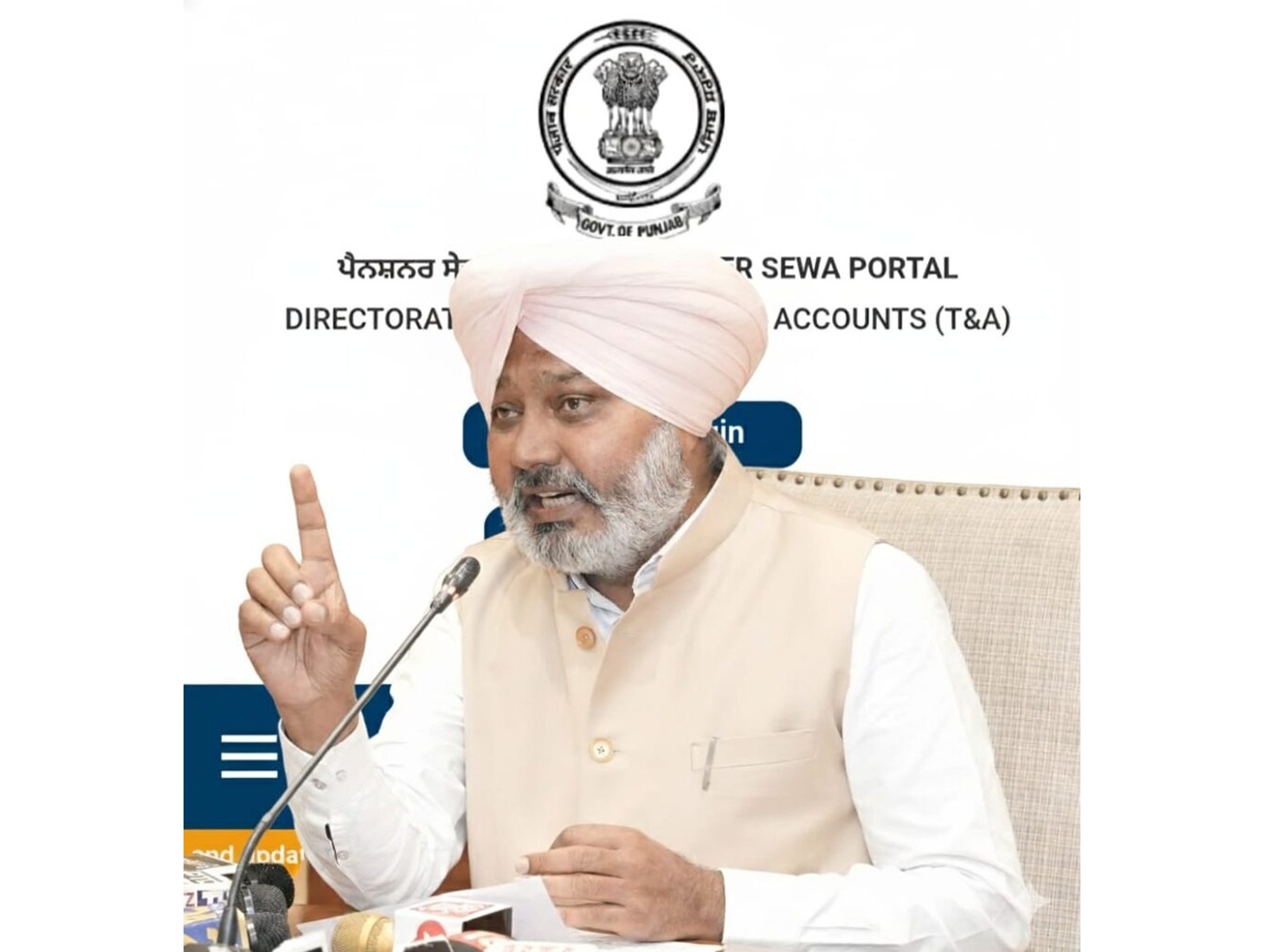

Punjab has reported a strong rise in Goods and Services Tax (GST) collections in January 2026, signalling improved compliance and steady economic activity, despite revenue pressures caused by recent tax rate changes. The state’s gross GST collection for the month stood at ₹2,452.66 crore. Net collections rose by ₹315 crore compared with January last year, marking a year-on-year increase of 15.7%, according to Punjab’s Finance, Excise and Taxation Minister Harpal Singh Cheema.

The growth comes even as Punjab faces an estimated monthly revenue loss of around ₹250 crore following GST 2.0 rate rationalisation by the central government. The changes have affected sectors such as textiles, pharmaceuticals, insurance, tyres and cement.

Officials said the state has managed to offset much of this impact through tighter enforcement and better tax administration. From April to January, net GST collections grew by 13.4%, increasing from ₹19,415 crore to ₹22,014 crore. Gross collections over the same period rose by 13%.

A key factor behind January’s performance was a sharp rise in State GST (SGST) cash collections, which grew by 14.4% — the highest among Indian states for the month. By comparison, the national average growth in GST cash collections was around 6%.

The government said it has also focused on easing the burden on compliant taxpayers. During January alone, ₹129 crore in SGST refunds were issued, while total GST refunds for the month were close to ₹300 crore.

Enforcement action has played a significant role as well. State Intelligence and Preventive Units reported recoveries of more than ₹200 crore in January by curbing input tax credit fraud and bogus billing. Total enforcement recoveries in the current financial year are approaching ₹1,000 crore, the highest recorded so far.

Punjab has also faced additional strain due to deductions of about ₹280 crore from its share of Integrated GST settlements over the past three months. Despite this, the state’s overall GST performance has remained strong.

The finance minister said the figures reflected a resilient tax base supported by data-driven enforcement, improved compliance and a balanced approach to revenue collection and taxpayer support.