The North News

Chandigarh, September 29

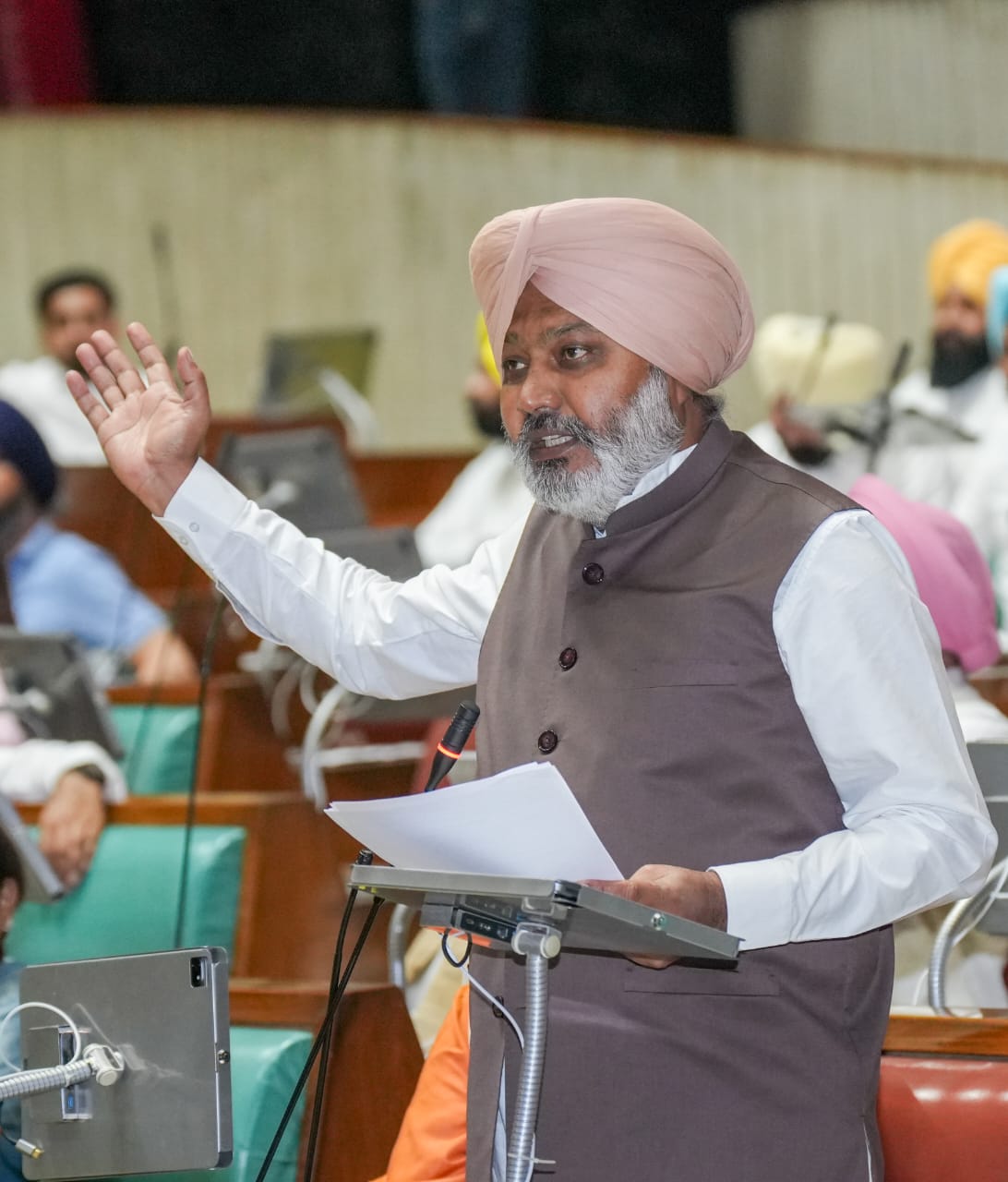

The Punjab Assembly on Monday unanimously passed the Punjab Goods and Services Tax (Amendment) Bill, 2025 and the Punjab Co-operative Societies (Amendment) Bill, 2025. Introducing the legislation, Finance Minister Harpal Singh Cheema said the GST bill amends several sections of the state’s 2017 Act to bring it in line with recent changes to the Central GST Act under the Finance Act, 2025. New provisions, including sections 122A and 148A, have also been added. Cheema defended the state’s position on GST, noting that Punjab has suffered significant revenue losses since its implementation. He said the state’s pre-GST revenue neutral rate was 18.3%, compared to a national average of 14%. Since GST was rolled out, Punjab has lost an estimated ₹1.11 lakh crore, receiving only about ₹61,000 crore in compensation.

Responding to criticism from opposition leader Pratap Singh Bajwa, Cheema recalled that GST was first proposed by Congress in 2006 under then-finance minister P Chidambaram, but later advanced by the BJP-led NDA as “One Nation, One Tax.” He accused the Union government of failing to honour its promise to continue the compensation cess until states stabilised.

The Finance Minister warned that if the Centre continues to ignore state concerns, India’s federal structure could be undermined. He said states risk being reduced to “municipal committees” subservient to the Union. Cheema accused the BJP of systematically weakening Ambedkar’s Constitution through policies such as “One Nation, One Tax” and “One Nation, One Election,” while reiterating that the Aam Aadmi Party opposed both.