North News

New Delhi, February 1

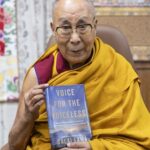

Announcing key tax relief measures, Finance Minister Nirmala Sitharaman on Saturday raised the income tax exemption limit to ₹12 lakh per year, offering relief to middle-class taxpayers. While presenting the budget, Finance Minister acknowledged the crucial role of the middle class in strengthening the economy and emphasized that the government has periodically reduced their tax burden. “I am pleased to announce that there will be no income tax on earnings up to ₹12 lakh,” she said. She further explained that the revised tax slabs and rates will benefit all taxpayers, with the new structure significantly reducing the tax burden on the middle class, leaving them with more disposable income to boost household consumption, savings, and investment.

She also doubled the tax deduction limit on interest for senior citizens from ₹50,000 to ₹1 lakh. The annual TDS limit on rent was increased from ₹2.4 lakh to ₹6 lakh, while the threshold for tax collection on remittances under the RBI’s Liberalized Remittance Scheme was raised from ₹7 lakh to ₹10 lakh.

In a push for technological innovation, 10,000 fellowships will be awarded under the PM Research Fellowship scheme over the next five years for research in IITs and IISc. Additionally, ₹20,000 crore has been allocated for a private-sector-driven R&D and innovation initiative announced in the July Budget.

For farmers, the Kisan Credit Card (KCC) loan limit was increased from ₹3 lakh to ₹5 lakh, benefiting 7.7 crore farmers, fishermen, and dairy farmers. The government will establish a 12.7 lakh metric ton urea plant in Namrup, Assam, while the Prime Minister Dhan Dhanya Krishi Yojana will support 1.7 crore farmers across 100 low-productivity districts with irrigation, storage, crop diversification, and credit access.

Sitharaman emphasized India’s robust economic growth, highlighting a decade of structural reforms and a vision for “Sabka Vikas.”